Forex Trading Strategies: A Comprehensive Guide

Updated January 5, 2024

Forex trading can be a complex and challenging activity, requiring a deep understanding of the market and a well-crafted strategy. In this comprehensive guide, we have explored some of the most popular forex trading strategies, including trend following, breakout trading, swing trading, range trading, and position trading.

By understanding the advantages and disadvantages of each forex trading strategy, traders can choose the strategy that best suits their trading style, risk tolerance, and financial goals with your own forex broker.

Forex trading is a popular form of investment that has gained significant traction in recent years. The forex market is the largest and most liquid financial market in the world, with an estimated daily trading volume of over $5 trillion. With its potential for high returns and the ability to trade around the clock, forex trading has become an attractive option for both retail and institutional investors.

In addition to developing a forex trading strategy, there are other key factors to consider when trading forex. These include choosing a reputable forex broker, managing risk effectively, and staying up-to-date on market news and trends. With the right approach and a solid trading plan, forex trading can be a rewarding and profitable activity for those who are willing to put in the time and effort.

🔝 Offer: Top Brokers For Forex In Malaysia

Moneta Markets clients from Malaysia are able to profit from the bullish and bearish moves of 300+ tradable instruments, such as Forex, Share CFDs, Indices, Commodities. Visit the site!

There is a reason why over 5 Million clients choose XM for Forex Trading, Stock Indices Trading, Commodity Trading, Stocks, Metals and Energies Trading. Over 1000 Instruments. Visit XM now!

Wherever your financial interests lie, you can rely on AVATrade. Want to start trading but not sure how? Discover and copy thousands of top traders. Get more info now!

📝 More forex broker reviews for traders from Malaysia:

📈 Creating your very own Forex Trading Strategy (A Step-by-Step Guide)

If you want to become a successful forex trader, developing a solid trading strategy is essential. However, with so many different strategies available, it can be difficult to know where to start. In this guide, we will take you through a step-by-step process to help you develop a forex trading strategy that suits your trading style and financial goals.

Step 1: Determine Your Trading Style: Before you can develop a trading strategy, you need to determine your trading style. Are you a day trader who likes to make quick trades and close positions by the end of the day? Or are you a position trader who prefers to hold positions for weeks or even months at a time? Understanding your trading style will help you select a strategy that fits your goals and trading preferences.

Step 2: Analyze Market Conditions: Once you’ve determined your trading style, you need to analyze the market conditions to identify the most suitable forex trading strategies. Consider the currency pairs you want to focus on, the size of your position, and whether you’re going long or short. These factors will help you narrow down your search and find the forex trading strategies that are best suited to your needs.

Step 3: Choose a Strategy: There are numerous forex trading strategies available, including trend following, breakout trading, and range trading. Once you’ve analyzed the market conditions, you can start selecting the strategies that align with your goals and preferences. It’s essential to take into account the strategy’s strengths and weaknesses, as well as how it fits with your trading style.

Step 4: Develop Your Trading Plan: After choosing a strategy, it’s time to develop a trading plan. This should include the details of your trading strategy, such as when to enter and exit positions, your stop-loss and take-profit orders, and your risk management strategy. Your trading plan should be comprehensive and detail-oriented, with clear guidelines on how to execute your trades.

Step 5: Test Your Strategy: Before putting your trading plan into action, it’s crucial to test your strategy on a demo account. This allows you to see how your strategy performs in real market conditions without risking real money. It’s an essential step in refining your strategy and identifying any areas that need improvement.

🔥 5 Most successful forex trading strategies explained

Trend Following Strategy

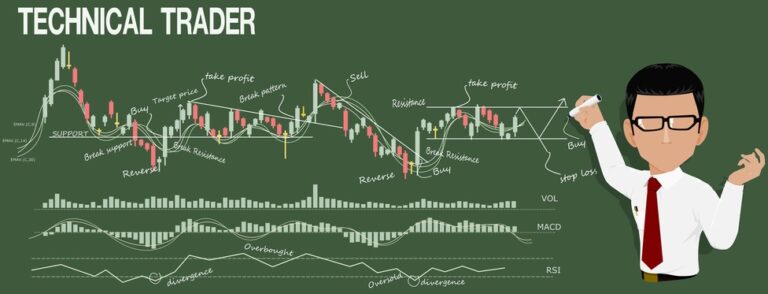

- The trend following strategy is one of the most popular and widely used forex trading strategies. It involves identifying the direction of the market trend and opening positions in the same direction. Traders using this strategy aim to profit from the momentum of the trend.

Advantages: Trend following is a straightforward and simple strategy that can be used by traders of all levels. It is also a popular choice for automated trading systems.

Disadvantages: Trend following can be less effective in choppy or range-bound markets, where there is no clear trend to follow.

Breakout Strategy

- The breakout strategy involves identifying key support and resistance levels and opening positions when the price breaks through these levels. Traders using this strategy aim to profit from the momentum of the price movement after a breakout occurs.

Advantages: Breakout trading can be an effective way to capture large price movements and generate substantial profits.

Disadvantages: Breakout trading can be more challenging than other forex trading strategies, as traders need to be able to identify key support and resistance levels accurately.

Swing Trading Strategy

- The swing trading strategy involves opening positions based on the price swings that occur within a longer-term trend. Traders using this strategy aim to profit from the smaller price movements that occur within the overall trend.

Advantages: Swing trading can be less risky than other strategies, as traders can enter and exit positions relatively quickly.

Disadvantages: Swing trading requires a deep understanding of the market and strong technical analysis skills to identify entry and exit points accurately.

Range Trading Strategy

- The range trading strategy involves identifying key levels of support and resistance and opening positions when the price approaches these levels. Traders using this strategy aim to profit from the price movements that occur within a defined range.

Advantages: Range trading can be an effective strategy in markets that are range-bound, with little or no clear trend.

Disadvantages: Range trading can be less effective in markets with strong trends or sudden price movements.

Position Trading Strategy

- The position trading strategy involves holding positions for a longer period of time, often weeks or months. Traders using this forex trading strategy aim to profit from the long-term trends in the market.

Advantages: Position trading can be one of the less time-intensive forex trading strategies, allowing traders to focus on other activities.

Disadvantages: Position trading requires a high level of discipline and patience, as traders may need to wait for weeks or even months to see a return on their investment.

🔍 What’s more to say?!

In conclusion, forex trading can be a highly rewarding form of investment, but it requires a strong understanding of the market and a well-crafted trading strategy. By exploring and implementing some of the popular forex trading strategies outlined in this guide, traders can improve their chances of success in the forex market. However, it is important to remember that trading forex involves a degree of risk, and traders should always approach the market with caution and manage risk effectively to ensure a sustainable and profitable trading experience.

To test your own forex trading strategies on demo accounts, there are a number of forex brokers operating in Malaysia, both local and international. Some of the most often used forex brokers in Malaysia include:

- FBS: FBS is an international forex broker with a strong presence in Malaysia. The broker is regulated by the International Financial Services Commission (IFSC) and offers a wide range of trading instruments, including forex, stocks, and commodities.

- XM: XM is another popular forex broker in Malaysia. The broker is regulated by several reputable regulatory bodies, including the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). XM offers a range of trading platforms, including the popular MetaTrader 4 and MetaTrader 5 platforms.

- Exness: Exness is an international forex broker that is popular among Malaysian traders. The broker is regulated by the Financial Services Authority (FSA) in Seychelles and offers a range of trading instruments, including forex, stocks, and cryptocurrencies.

- HotForex: HotForex is a well-established forex broker that is popular among traders in Malaysia. The broker is regulated by several regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa.

- OctaFX: OctaFX is another popular forex broker in Malaysia. The broker is regulated by the International Financial Services Commission (IFSC) and offers a range of trading instruments, including forex, metals, and cryptocurrencies.

More On Forex Trading

⁉️ Forex Trading Strategies FAQ

What is the best forex trading strategy for beginners?

For beginners, a simple strategy like trend following or breakout trading can be a good starting point. These strategies are relatively easy to understand and implement, and they can provide a good foundation for more advanced forex trading strategies.

Should I use a single forex trading strategy or combine several?

It depends on your trading style and preferences. Some traders find success using a single strategy, while others prefer to combine several strategies to diversify their trading portfolio and minimize risk.

How can I test a forex trading strategy before using it in real markets?

You can test a forex trading strategy by using a demo trading account. This allows you to practice your strategy in a simulated market environment without risking real money.

What are the key factors to consider when choosing a forex trading strategy?

When choosing a forex trading strategy, you should consider factors such as your trading style, the market conditions, the currency pairs you want to focus on, and your risk tolerance. You should also choose a strategy that aligns with your financial goals.

Can I modify a forex trading strategy to suit my preferences?

Yes, you can modify a forex trading strategy to suit your preferences. However, it’s important to ensure that any modifications you make don’t compromise the effectiveness of the strategy. Any modifications should be thoroughly tested on a demo account before using them in real market conditions.