A forex demo account is a simulated trading environment that offers potential traders the opportunity to explore forex markets and practice trading without the risk of losing real money. These accounts provide virtual funds, allowing users to test out trading strategies and become familiar with the tools and features of a trading platform. They serve as an educational resource, helping new traders understand market dynamics and develop trading skills in a controlled, risk-free setting.

Using a forex demo account helps bridge the knowledge gap for newcomers before they commit their actual funds. It is a valuable tool for gaining experience with the mechanics of trading, such as executing trades, managing positions, and using leverage. Transitioning from a demo account to a live trading account should involve a thorough understanding of the potential financial risks and the psychological differences of trading real money.

Key Takeaways

- Forex demo accounts enable risk-free trading practice with virtual funds.

- They are crucial for learning trading platform features and market behavior.

- A careful approach should be taken when moving from a demo to a live account.

Trade Forex, Crypto CFDs, Stocks, Metals and more! Licensed and regulated Broker in Malaysia! $50 No Deposit Bonus!

Understanding Forex Demo Accounts

Forex demo accounts create a simulated trading environment where individuals can practice trading without financial risk. They are foundational for acquiring trading experience.

Definition and Purpose

A Forex demo account is a virtual trading platform where potential traders can practice buying and selling currencies. The purpose of these accounts is to simulate real trading scenarios without the need of committing real money, allowing users to learn how to trade and to get accustomed to the platform.

Features of Demo Accounts

Demo accounts offer many of the same features as live accounts, such as:

- Real-time market data

- Access to trading tools and charts

- The ability to execute trades instantly

However, these trades are executed with virtual funds.

Benefits for Beginners

For newcomers, the primary benefits of using demo accounts are:

- Risk-free practice: Beginners can build skills without the fear of incurring losses.

- Understanding market dynamics: They gain firsthand experience with Forex market fluctuations and trends.

- Learning platform functionalities: Users familiarize themselves with the trading platform’s tools and features, which helps in a smoother transition to live trading.

Setting Up a Demo Account

A demo account serves as a practical tool allowing potential traders to familiarize themselves with trading platform functionalities and experiment with forex trading without financial risk.

Choosing a Platform

Traders must select a forex platform that best aligns with their individual trading style and needs. A platform should offer:

- Competitive spreads: Lower spreads can lead to cost savings on trades.

- Diverse currency pairs: More pairs increase opportunities for trading.

- Customer support: Essential for resolving any issues that arise.

Registration Process

The process generally involves:

- Providing personal information: This may include name, email, and phone number.

- Verification: Some platforms require ID for a demo account.

- Confirmation: After registration, the trader will receive account details via email.

Customization Options

Platforms typically offer various customization settings, including:

- Virtual fund amount: Traders can typically choose the amount of virtual currency.

- Trading pair preferences: Individuals can select which currency pairs to focus on.

- Chart tools and indicators: These help in analyzing market trends and data.

Using a Forex Demo Account

A Forex demo account serves as a simulation of real trading on the Forex market, allowing users to get accustomed to platform navigation, practice trading strategies, and analyze market conditions without financial risk, using virtual funds.

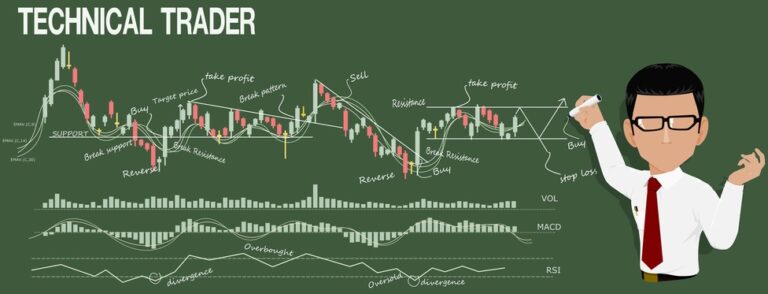

Navigating the Trading Interface

Users begin by accessing the trading platform interface, which typically includes real-time market data, various charting tools, and options for executing trades. It’s crucial for traders to familiarize themselves with these tools to effectively monitor and participate in the Forex market. Key elements to become proficient in include the order entry process, setting stop-losses, and tracking open positions.

Practicing Trading Strategies

With virtual funds, individuals practice executing trades and refine their trading strategies to understand how they would perform in live markets. Traders can experiment with different techniques, such as day trading or swing trading, and learn how to adapt strategies in response to market movements. The goal is for traders to develop a reliable approach before transitioning to a live account.

Analyzing Market Conditions

A demo account provides the perfect environment for traders to analyze market conditions and test how these conditions affect their trading strategies. This includes understanding how to read Forex charts, recognizing trends, and interpreting economic news that can impact currency values. Mastery of these analytical skills is crucial for making informed trading decisions when engaging in live Forex trading.

Limitations of Demo Accounts

Forex demo accounts offer a valuable platform for learning and practice. However, they come with limitations that can affect the transition to live trading.

Lack of Emotional Engagement

In a demo account, trades are executed with virtual money, which can result in absence of real emotional stakes. She does not feel the pressure of real financial loss, leading to a skewed perception of trading risk.

Discrepancy in Execution

Trade execution in a demo environment may not accurately represent live trading conditions. Slippage and order filling can differ, providing her with an unrealistic expectation of how trades would be executed in the market.

Overconfidence Risk

Demo accounts can lead to a false sense of confidence. The risk-free environment doesn’t penalize her mistakes, which can lead to overestimating her trading abilities when transitioning to a real account.

Transitioning to a Live Forex Account

Transitioning from a forex demo account to a live account is a significant step for traders. It involves preparation, understanding of real market conditions, and a shift in psychological mindset due to the involvement of real capital.

When to Make the Switch

Traders should consider moving to a live account when they have consistently achieved profitable trades in their demo account and have a solid understanding of market analysis and risk management. Key indicators include comfort with the trading platform, a well-tested trading strategy, and the ability to control emotions during trades.

Steps to Transition

To transition to a live account:

- Evaluate Readiness: Confirm consistent profitability and strategy effectiveness in the demo account.

- Choose a Broker: Select a reputable broker with favorable trading conditions for your strategy.

- Risk Management: Establish strict risk management rules to protect your capital.

- Start Small: Begin trading with a small amount of capital to minimize risk.

- Monitor and Reflect: Continuously evaluate trade performance and adjust strategies as needed.

Adjusting to Real Market Conditions

Once trading with a live account, traders need to be prepared for the impact of real market conditions, including slippage, latency, and liquidity variations. Traders must also manage the psychological differences, such as the stress of potential losses, which can influence decision-making. Discipline and emotional control are crucial for adapting successfully to live trading.

Conclusion

Forex demo accounts serve as an invaluable tool for novice traders. They offer a simulated trading environment where one can practice without the risk of losing real money. Using virtual funds, traders can execute transactions, developing familiarity with the market’s movements and refining their trading strategies.

Key takeaways include:

- Traders gain experience in executing trades and using the trading platform provided by brokers.

- The virtual trading environment replicates real market conditions, ensuring relevant learning experiences.

- Demo accounts are a testing ground for new strategies without financial consequences.

One should note that while demo accounts simulate real trading conditions, they cannot replicate the psychological pressures of real-life trading with actual capital at stake. Nonetheless, for traders seeking to build confidence and competence in the forex market, demo accounts are an essential step in education and skill development. They pave the way for a smoother transition to trading with real funds.